Using A HELOC To Put Your Home Equity to Work

4/09/2021

Your home equity can create a lot of borrowing power for you. You can take advantage of your home equity by borrowing against it through different kinds of credit. Home Equity Lines of Credit (HELOCs) can be a great option for utilizing equity in your home.

Before opening a line of credit based on your equity, there are a lot of things you should consider. Like any loan or line of credit, HELOCs have advantages and disadvantages. It’s important to be sure that a HELOC makes sense for you and your family.

Apply for a HELOC today with Arkansas Federal Credit Union. Arkansas Federal offers HELOCs with low interest rates and easy access to your funds.

What is home equity?

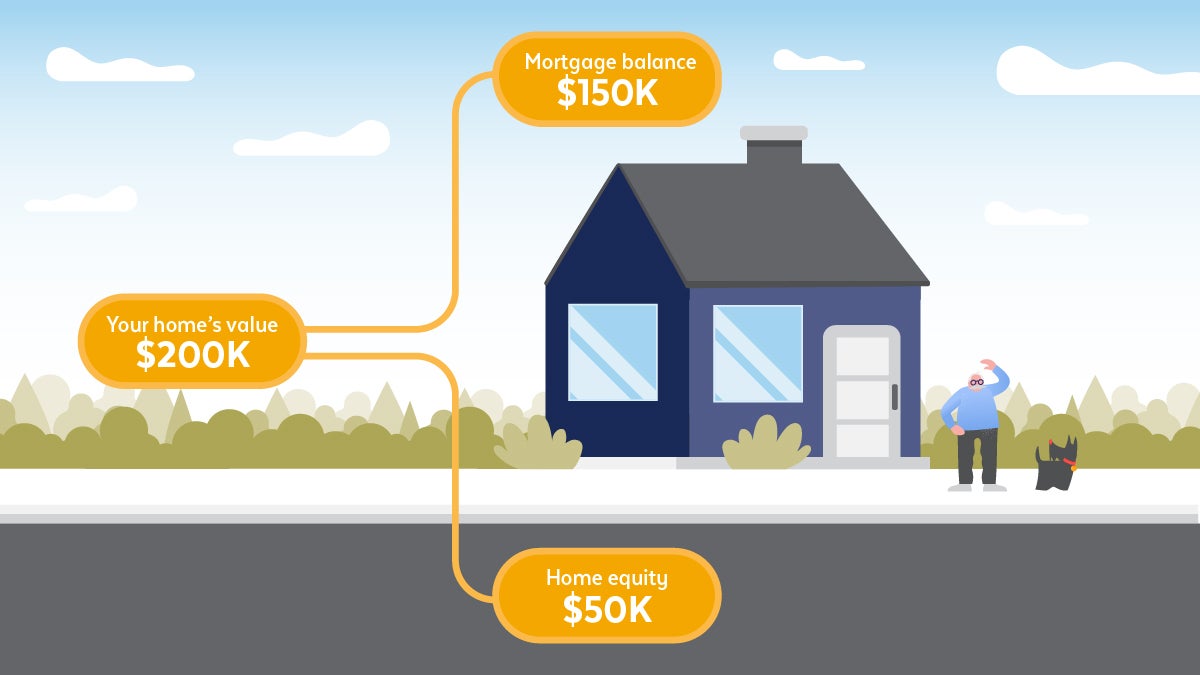

Home equity is essentially the amount of your home that you own. To calculate your home’s equity, you take your home’s market value and subtract the amount you owe on your mortgage. For example, if your home is worth $200,000 and you owe $150,000 on your mortgage, you would have $50,000 in equity.

You can take advantage of the equity in your home by using it as collateral for a HELOC or home equity loan. These allow you access to funds that would otherwise be equity in your home.

What Is a HELOC and How Does It Work?

A HELOC is a line of credit based on the equity you have in your home. You most likely won’t be able to get a HELOC for the entire amount of equity you have in your home, but you could potentially have up to 95% of your equity available in a HELOC.

When you have a HELOC, you can use it similarly to how you would use a credit card. You can take money out and pay it back as you need.

Most HELOCs have a draw period of about ten years. During this time period, you can withdraw money as you need while only paying interest back. After the draw period ends, you’ll move into the payback period of your HELOC. The payback period is usually longer. Twenty years is a typical payback period. While paying back your HELOC during this time, you’ll make payments that include the principal amount and interest.

How To Use a HELOC

There are a lot of different ways you can use a HELOC. You can use and access your HELOC at any time throughout your borrowing period. You’ll have access to your funds on your schedule when you need them.

Using a HELOC for big purchases or expenses is a good idea. HELOCs are commonly used to finance things like home renovations or home improvement projects. Improving your home with your HELOC is a great way to use your equity because it helps increase the value of your home.

You don’t have to only use HELOCs for costs related to your home. HELOCs are also a good option for consolidating debt. If you have a lot of high-interest debt, you can pay it off with the money from your HELOC and only have to worry about making HELOC payments.

There are a lot of different ways that you can use a HELOC. Once you have it, you have free reign to decide how to spend that money. It’s important to consider how you plan to use your HELOC. It’s not recommended to use HELOCs for smaller payments or for things that are considered more basic needs that don’t help you get out of debt or build your wealth.

How to Get a HELOC

The most important requirement to getting a HELOC is having available equity in your home. In order to borrow against your equity, you have to have it. You can calculate your existing equity in your home to get an idea of how much you might be able to borrow through your HELOC.

Gathering the appropriate documentation is important for your HELOC application to get approved. In order to get a HELOC, you’ll need to provide your lender with financial information. W2s, pay stubs, mortgage information, and identification documents are required. Your mortgage information is typically needed to prove the amount of equity you have in your home and that you’re in good standing with your mortgage. Similarly, your pay stubs and W2 are used to show that you have consistent employment and would be financially able to make HELOC payments.

Closing costs are an important part of getting your HELOC. When getting your HELOC, there could be closing costs of anywhere from 2-5%. There could also be annual fees that you have to maintain. When HELOCs have annual fees, they can be somewhere around $50.

If you’re interested in getting a HELOC, it’s important to consider the fees and costs that come with it. However, it’s worth noting that some lenders, like Arkansas Federal, offer HELOC with no fees. So, if you’re looking for a HELOC without fees, it might be worth considering checking out what Arkansas Federal has to offer.

Advantages of a HELOC

HELOCs offer a lot of flexibility at a relatively low cost. There are a lot of reasons that could make using a HELOC a great option for you.

Home Improvement

HELOCS are a great tool to use to finance home renovations or improvements. Home improvement projects can be expensive, so taking advantage of your home equity to finance them can make it much easier for you. Using a HELOC for home improvement projects is a great idea because while you’re borrowing against your home equity, your project can help increase the value of your home.

Low-Interest Rate

With a HELOC, you are borrowing against your home equity, so your line of credit is secured by a loan. You can get a better interest rate with a HELOC because your house is collateral, unlike with an unsecured loan or credit card.

Flexibility

Borrowing with a HELOC is flexible to your needs. HELOCs typically have long borrowing periods, and you can borrow funds however you need during that time. If you plan to work on home renovations throughout your borrowing period, you can access funds whenever you need to make payments or purchases. This differs from most other borrowing options, where you’re paid in a lump sum.

Easy Access

With a HELOC, you have easy access to your funds. You can access your funds and make payments online or through the Arkansas Federal app. Your money is easy to access in a similar way to how you access credit from a credit card.

Tax Deductions

The interest that you pay on your HELOC could be tax deductible. If you use your HELOC funds to buy, build, or substantially improve your home and your HELOC and mortgage meet certain loan limits, your interest payments could be tax deductible.

Disadvantages of a HELOC

Depending on how you plan to use your HELOC, it might not be the best credit or loan option for you. There are some specifics that you should consider before applying for a HELOC.

Foreclosure

Before applying for a HELOC, you should make sure that you feel comfortable financially with your current mortgage payments. If you get a HELOC and are unable to make your payments, especially if you’re unable to make payments because of your mortgage payments, you could be at an increased risk of foreclosure. The more loans you have with your house as collateral, the higher the risk for foreclosure because if you fall behind on any of the loans, your lenders could foreclose.

Variable Interest Rates

HELOCs have variable interest rates, which means that the funds can change as frequently as every six weeks based on the federal funds rate. Throughout your loan, your interest rate could rise or fall without any warning. If your income is unstable or you aren’t sure if you’ll be able to afford payments if your interest rate rises, a HELOC might not be the best option for you.

Moving

If you think you might be moving and selling your home in the near future, a HELOC might not be the ideal solution for your credit needs. One of the main benefits of a HELOC is the long borrowing period and payment timeline. If you sell your house, you’ll have to pay off your HELOC entirely at the time of the sale. Paying off your HELOC early could be a major financial burden.

Borrowing Amount

HELOCs typically allow you to borrow a sizeable amount of money. If you aren’t looking to borrow a lot of money, the cost of a HELOC and interest over time might not be worth it in the long run.

Borrowing Needs

HELOCs are best used on costs like home renovations that help build your wealth. If you need funds for more basic needs, a different borrowing option might fit your needs better. Because of the long borrowing period and longer payback period, HELOCs aren’t considered the best option for costs that don’t add value to your home or help you build wealth in any way.

Apply For a HELOC Today

HELOCs can be a great borrowing option if they fit your needs and your plans. The flexibility in borrowing and easy access to funds make them great for a variety of different projects and needs.

While HELOCs come with a lot of positives, it’s important to consider how one would fit into your life and your financial situation. Before applying for a HELOC, you should consider how it could impact you.

The online application process has never been faster or easier. Apply for a HELOC with Arkansas Federal today.