Historic Low Rates: Purchase. Refinance. Save.

9/21/2020

Are you considering purchasing a home, building, or refinancing? There has never been a better time to lock in rates that can save you a bundle over the course of your home loan! According to Freddie Mac, one of the leading U.S. secondary mortgage market providers, mortgage rates have fallen more aggressively than ever, and they have been remarkably setting record after record. In fact, just within the past few weeks, 30-year, fixed average mortgage rates fell to the lowest rate ever recorded by Freddie Mac since 1971.1

Compared to a Year Ago

In 2019, the yearly average rate on a 30-year fixed mortgage was at 3.94%, which meant a $300,000 mortgage payment would be $1,422 per month.2 Compare that to a rate drop at 2.94% in August 2020 and the payment would drop to $1,255. Over the span of 360 payments (30 years), that’s a savings of $60,120!2 Your actual savings may vary, but you can clearly see the difference a lower mortgage rate can make.

Lower Rates Makes Homes More Affordable

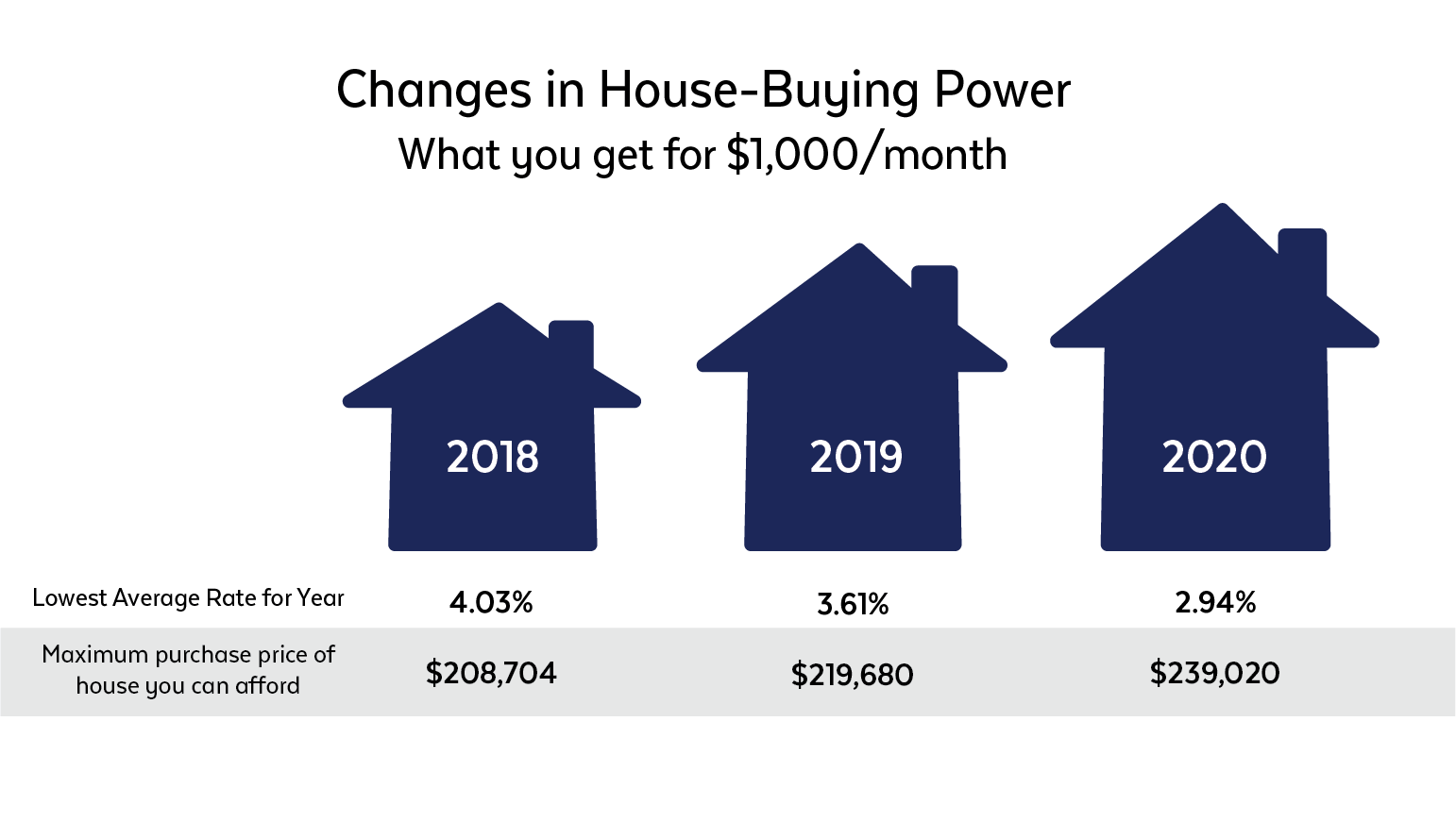

Simply put, lower rates mean lower monthly mortgage payments. As rates decline, buying, purchasing, or refinancing a home becomes even more affordable. The lower rates not only mean a lower monthly payment, but they also give buyers more purchasing power, as shown below. Compared to previous year averages, today’s buyers can afford more house than ever before.

Let’s say you want to keep your monthly payments to $1,000 per month. Here’s how that looks with different interest rates over the past few years. For the purposes of this example, down payments, mortgage P&I and escrow are not included in these examples.

That’s a total home value difference of more than $30,000 in just a few years.

Act Fast to Lock Your Low Rate

To take advantage of these record low rates, it’s important to act fast to lock in your rate. Whether you’re a first-time homebuyer, looking to build, wanting to move into a bigger home, interested in refinancing your current home, or considering a Home Equity Line of Credit, now is the perfect time to act!

Contact us at 800.456.3000, visit your local branch, or apply online in under 20 minutes and get pre-qualified here

1. http://www.freddiemac.com/pmms/

2. Results are for illustration purposes only and are hypothetical. The examples provided do not take into consideration a down payment, property taxes or insurance. APR and payment may vary based on the specific terms of the loan selected, verification of information, credit history, the location and type of property. Freddie Mac rates quoted as of September 16, 2020 and may have changed since the publication of this article.