Debt Consolidation Options

Learn about all of your debt consolidation loan options and what's the best option for you.

Read More

Struggling to juggle multiple debts from high-interest credit cards, loans, or bills? Don’t let financial stress overwhelm you. Instead, consolidate your debt into a single, manageable loan. With lower interest rates or extended repayment terms, you can regain control of your finances. Whether it’s through a personal loan, home equity loan, or low-interest credit card, our expert team can guide you toward the right solution. Take control of your finances today. Please note that this involves securing a new loan to pay off existing debt. Minimum credit score and debt-to-income requirements are required.

Combining multiple debts into a single loan reduces the number of payments and interest rates you have to worry about–one loan, one monthly payment.

Your overall monthly payment may decrease when payments are spread out over a longer period of time or if you receive a lower interest rate,1 freeing up some extra monthly cash.

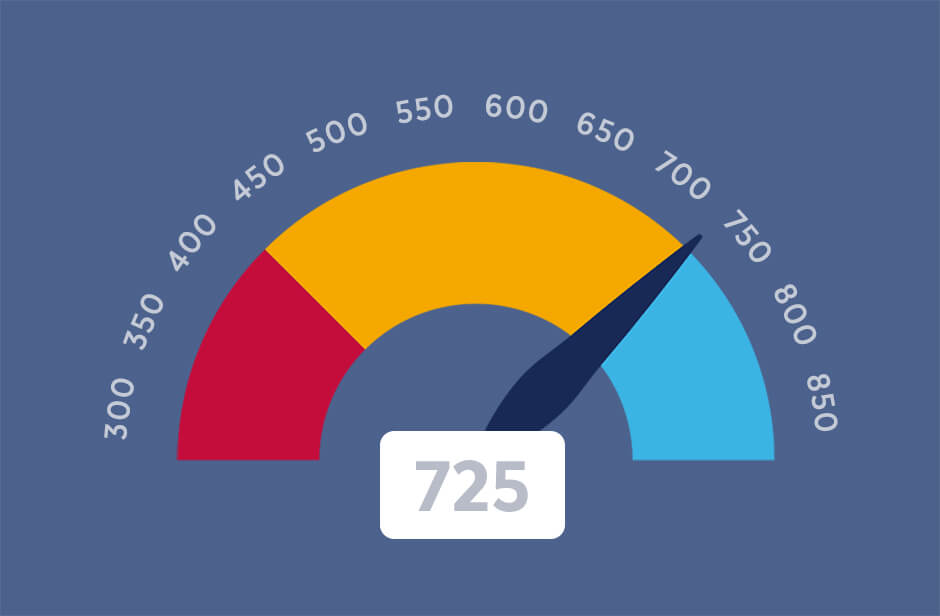

Paying off multiple debts through consolidation could improve your credit utilization ratio (the amount of debt you have relative to your available credit), which may improve your credit score.

Consolidating debt means rolling multiple debts, typically high-interest debt such as credit card bills, into a single payment. By doing so, you may be able to obtain more favorable payoff terms, such as a lower interest rate, lower monthly payments, or both. But debt consolidation isn’t one size fits all. Depending on your unique situation, there are several loan options to consider. Find the one that’s best for you below.

Just answer a few questions, and we’ll help point you in the right direction.*

*The content of this quiz is for illustrative and informational purposes only and may not apply to your individual circumstances.

Debt consolidation is a three-step process:

Debt consolidation could be a good fit if you’re struggling to pay your creditors each month.

Debt consolidation combines multiple debts into a single loan. Combining your debt into one monthly payment simplifies your debt and makes it easier to manage. Plus, debt consolidation could save you money because it may also reduce the overall interest you pay.

Most people find that a personal loan is best to consolidate debt, especially if they don’t own a home. Personal loans are considered unsecured, meaning they don’t require collateral. However, if you’re a homeowner, you may find that a home equity loan may be a better option. As you can see, debt consolidation isn’t one-size-fits-all. That’s why we offer several ways to consolidate debt through personal loans, home equity loans, auto or home refinances, and low-rate credit card balance transfers. To find out which is best for you, take our debt consolidation quiz or call us at 800.456.3000.

Enjoy $0 application fees on most of our debt consolidation options (personal loans, low-rate credit cards, auto refinances, and home equity loans). However, a home refinance will come with closing costs and fees.

Our rates may vary depending on your credit score and underwriting factors. So, check your score before consolidating. An easy way to do this is through Credit IQ if you’re an Arkansas Federal member. It’s a free tool; once you know your credit score, you can even find tips to improve it if needed.

The first step to determining how much you should consolidate is to determine your debt. Add up all of your debt to help you determine how much to borrow.

You can view your monthly payment history and account balances through our Digital Banking, available on mobile and desktop.

While everyone’s credit situation differs, debt consolidation can improve your credit score over time if you make regular on-time payments.

Unlike credit cards with a variable or changing rate, when you consolidate your debt with a personal loan, home equity loan, or refinance your home or auto loan, you’ll enjoy the same monthly fixed payment. So, there are no surprises. Plus, you’ll have a set payoff date and know exactly when it will all be paid off. Win-win! However, if you consolidate your debt with a low-rate credit card, you may experience lower payments than you’re used to, but this rate is still variable and may change.

Get notifications on credit changes and monitor your progress with no impact to your score.