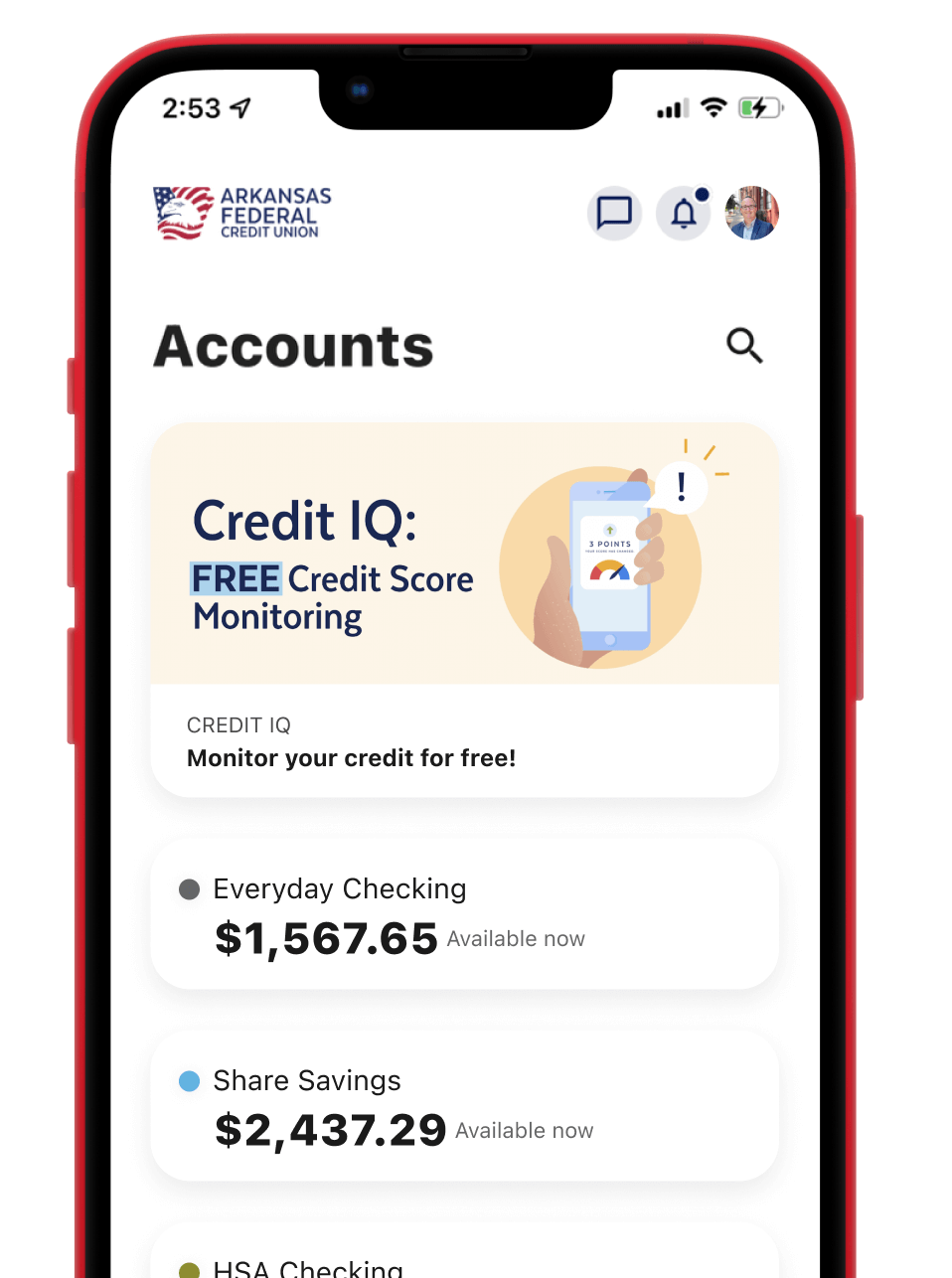

High-Yield Checking

as high as

6.00

%

APY

APY is the Annual Percentage Yield. Elite Checking is a tiered rate variable product. The rate is effective as of 09/01/2023. To qualify for the 6.00% APY, the member must have a monthly direct deposit of at least $1,000 going to their Elite Checking, be enrolled in eStatements, be in good standing, and complete 15 monthly transactions of at least $10 each by using their debit card tied to the account. The 15 required transactions must post to the account within the calendar month to receive earnings. When all requirements are met, 6.00% APY applies to balances up to $10,000.00, and anything $10,000.01 or more earns 0.05% APY. If the monthly qualifications are not met, the account will earn a reduced rate of 0.05% for the entire balance. Fees could also reduce earnings. A $15 monthly fee applies if the daily balance drops below $2,500.00. Only one Elite Checking or Premium Checking account per member is allowed. Offer and rates are subject to change. Exclusions may apply. Refer to the rate sheet for full details. Membership with Arkansas Federal Credit Union is required.

From high yields to no frills, find the account for you.