Turn Your Home’s Equity Into Cash

3/14/2024

Are you needing extra cash to fund a home renovation, consolidate your debt, pay for a dream wedding, or something else? Look no further than your home equity. With home values at an all-time high, you may have equity to tap into to use for just about anything you need.

And the best part? You can keep your current mortgage and rate while accessing your equity funds now. So, how do you do it? While there are several ways to access your home equity, you generally have two options: a cash-out refinance or a home equity loan.

A cash-out refinance replaces your existing mortgage with a new mortgage for a higher amount (existing mortgage balance + home equity). If you don’t want to sacrifice your current mortgage, rate, or term, a better alternative is a home equity loan, which allows you to keep your current mortgage while getting a fixed-rate loan for the equity only.

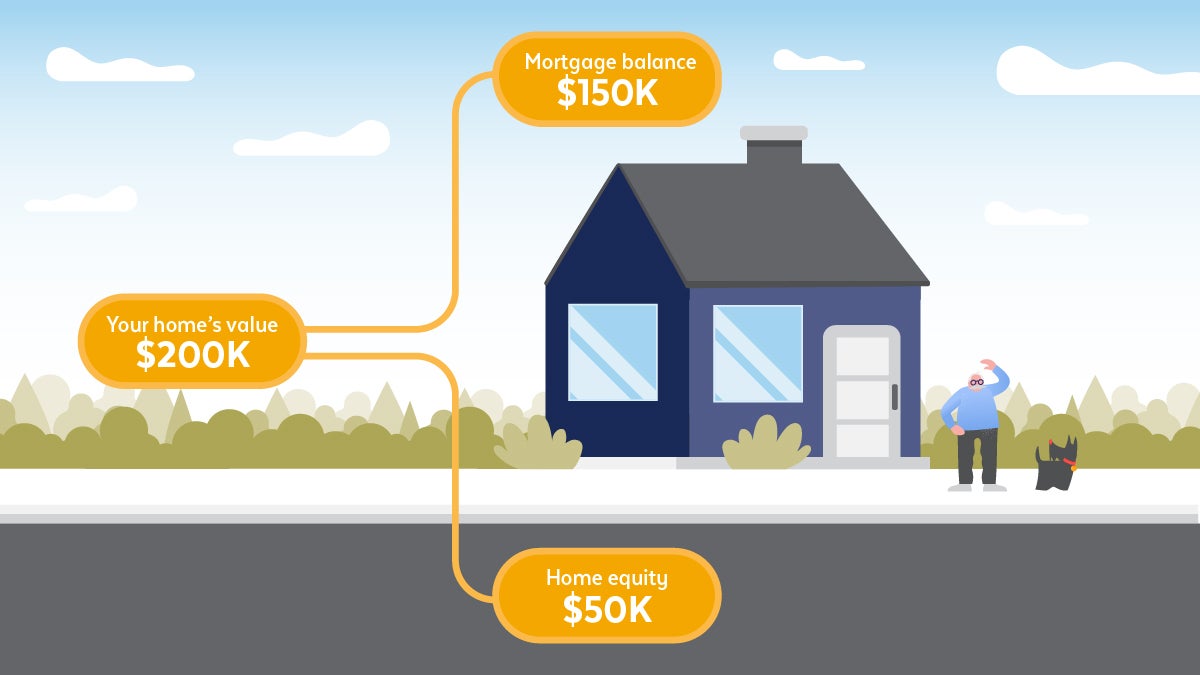

What is home equity?

Home equity is the home’s appraised market value minus what you owe on your mortgage. To calculate equity, you take the market value of your home and subtract the amount you owe on your mortgage.

For example, if your home is worth $200,000 and you owe $150,000 on your mortgage, you have $50,000 of equity.

How does a home equity loan work?

A home equity loan works much like a personal loan. You’ll receive your funds in a single lump sum. You then repay the loan in set monthly payments over the repayment period. Because home equity loans come with a fixed rate, you can expect the same monthly payment—no surprises. Assuming you make every payment, you’ll fully pay off your loan by the end of the agreed-upon term. Also, a home equity loan is secured, meaning should you not make payments, the lender can seize your home as collateral. However, because it is secured, your rate is typically lower than other types of loans.

How much can I borrow with a home equity loan?

The amount depends on the amount of equity you have in your home, along with other factors, such as your credit history and debt-to-income ratio. Generally, you can borrow up to a certain percentage of your equity. Each lender has different limits. For example, you can borrow up to 95% of your home’s equity at Arkansas Federal Credit Union. So, if you have $50,000 in equity, you can borrow $47,500 (95% of $50,000).

What can I use the money for?

You can use your equity money for just about anything:

- Home improvements

- Debt consolidation

- Vacation

- A dream wedding

- Emergency fund

- Or anything else

The advantages of a home equity loan

A home equity loan comes with several advantages.

- Easier to obtain. A home equity loan can be easier to obtain than some other types of loans, such as personal loans.

- Keep your current mortgage. Your mortgage remains separate from your home equity loan, so your current mortgage rate and term don’t change.

- Lower rate. A home equity loan typically has a lower rate than other types of loans, such as a personal loan or credit card.

- Fixed rate with predictable payments. A fixed rate means your monthly payment remains the same throughout the length of the loan—no surprises.

- One lump sum. You’ll get one lump sum upfront to use immediately but repay monthly.

- Up to 95% financing.1 With Arkansas Federal, you can access up to 95% of your home’s equity.

- It may be tax deductible. The funds could be tax deductible depending on how you use the money, such as with home improvements.2

Ready to get started? It’s easy.

Applying for a home equity loan is easy and can be done online. Plus, there’s no application fee. Don’t let your equity go unused – tap into it now.

Related Resources

-

Read Advantages of a Credit Union Home Equity Loan

-

Read Second Quarter 2024 Banner Newsletter

Second Quarter 2024 Banner Newsletter

-

Read How To Fund Home Improvement Projects

How To Fund Home Improvement Projects